The Role of Pet Insurance in Covering FIP Treatment Costs

Understanding Policy Limitations and Exclusions

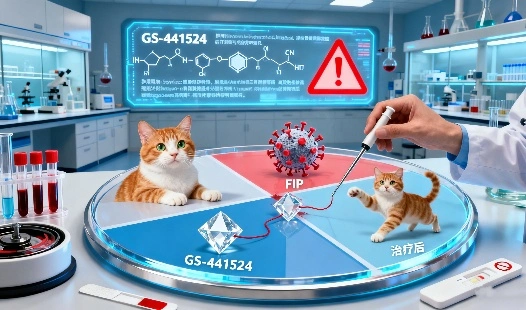

Cats all across the globe are susceptible to the fatal illness known as Feline Infectious Peritonitis (FIP). More and more, pet owners are looking for solutions to handle the expenses that come along with treatment alternatives, such as promising medicines like GS-441524. To help cat owners cope with this difficult diagnosis, this article looks at how pet insurance may cover the costs of FIP treatment.

|

|

|

|

Comparing FIP Coverage Across Providers

When considering pet insurance for FIP treatment, it's essential to compare coverage options across different providers. Not all insurance plans are created equal, especially when it comes to covering treatments for complex conditions like FIP.

Comprehensive Vs. Accident-Only Plans

Pet insurance providers typically offer two main types of plans: comprehensive and accident-only. For FIP treatment coverage, a comprehensive plan is generally necessary, as it includes coverage for illnesses as well as accidents.

Reimbursement Rates And Annual Limits

Insurance providers vary in their reimbursement rates and annual limits. Some may offer 70-90% reimbursement, while others provide 100% coverage after a deductible. Annual limits can range from a few thousand dollars to unlimited coverage.

Waiting Periods For FIP Coverage

Most pet insurance policies have waiting periods before coverage begins. For FIP, this waiting period can be crucial, as early treatment is often vital for successful outcomes. Some providers may have shorter waiting periods for certain conditions, so it's worth investigating these details.

Understanding Policy Limitations and Exclusions

While pet insurance can be invaluable for covering FIP treatment costs, it's crucial to understand the limitations and exclusions that may apply to your policy.

Pre-Existing Conditions

Many pet insurance providers exclude coverage for pre-existing conditions. If your cat has already been diagnosed with FIP before you purchase insurance, treatment costs may not be covered. This underscores the importance of obtaining insurance early in your pet's life.

Experimental Treatments

Some insurance providers may classify certain FIP treatments, particularly newer options like GS-441524, as experimental. This classification could affect coverage, so it's essential to clarify with potential providers how they handle emerging treatments.

Age Limitations

Some insurance plans have age restrictions or reduced coverage for older cats. Given that FIP can affect cats of any age, it's important to consider how age limitations might impact your coverage.

|

|

|

|

Maximizing Benefits: Tips for Claims

To get the most out of your pet insurance when dealing with FIP treatment, consider the following tips for managing claims:

Detailed Documentation

Maintaining comprehensive documentation is one of the most effective ways to streamline your insurance claim process for FIP treatment. Keep organized records of every veterinary consultation, diagnostic test, lab report, prescribed medication, and treatment receipt. This includes notes on your cat's condition, photos if relevant, and any communication with the vet regarding progress. Many insurance providers require detailed proof of medical necessity, so having a clear paper trail can prevent disputes and speed up claim approval. Consider using digital folders or spreadsheets to track dates, costs, and treatment phases, ensuring nothing is overlooked. Accurate and thorough documentation can make the difference between a partial reimbursement and full coverage.

Understanding Your Policy's Claim Process

Every insurance company has its own procedures and timelines for handling claims related to FIP treatment. Take the time to read your policy carefully, paying special attention to sections covering deductibles, waiting periods, and claim submission methods. Some insurers may provide direct billing options, while others require you to pay out-of-pocket and later request reimbursement. Knowing these details in advance allows you to budget effectively and avoid unexpected financial strain during your cat's recovery. Keep track of claim deadlines and required forms, and consider contacting your insurance provider for clarification if anything is unclear. Being proactive ensures your claims are processed smoothly and without unnecessary delays.

Communicating with Your Veterinarian

Your veterinarian plays a vital role in the success of your insurance claim for FIP treatment. Maintain open and transparent communication to ensure all essential details—diagnosis codes, treatment notes, and itemized invoices—are accurately recorded. Many insurers request specific terminology or documentation formats, so your vet's cooperation can help ensure compliance with claim requirements. If possible, inform your vet about your insurance provider's preferred claim format or any additional forms that need to be completed. Regularly review medical records for accuracy and request copies after each visit. This level of coordination not only simplifies the claims process but also builds a reliable record of care that supports long-term treatment planning and accountability.

|

|

|

|

Conclusion

Pet insurance can play a significant role in managing the costs associated with FIP treatment, including innovative therapies like GS-441524. By carefully comparing providers, understanding policy limitations, and maximizing your benefits through proper claim management, you can ensure that your feline companion receives the best possible care without overwhelming financial burden.

As research continues and new treatments emerge, having comprehensive pet insurance can provide the flexibility and financial support needed to access cutting-edge therapies. While the landscape of FIP treatment is evolving, pet insurance remains a valuable tool for cat owners committed to providing the best care for their beloved pets.

FAQ

1. Q: Does pet insurance typically cover FIP treatment?

A: Many comprehensive pet insurance plans cover FIP treatment, but coverage can vary between providers. It's important to carefully review policy details and discuss FIP coverage specifically with potential insurers.

2. Q: Can I get insurance for my cat after an FIP diagnosis?

A: While you can obtain insurance after an FIP diagnosis, most providers will consider it a pre-existing condition and may not cover related treatments. It's best to insure your cat early, before any health issues arise.

3. Q: How do I choose the best pet insurance for FIP coverage?

A: To choose the best insurance for FIP coverage, compare reimbursement rates, annual limits, and waiting periods across providers. Look for plans that explicitly cover new or emerging treatments, and consider the insurer's reputation for handling claims related to complex conditions like FIP.

Secure Your Cat's Future with BLOOM TECH's GS-441524

Supporting doctors and pet owners in the battle against FIP is BLOOM TECH's top priority as a supplier of GS-441524. Make sure your feline friends get the finest treatment possible with our pharmaceutical-grade GS-441524. Pet insurance companies find it simpler to pay for these vital therapies because to our dependable supply chain and affordable prices. Avoid putting off your cat's health care because of cost. Choose BLOOM TECH as your trusted GS-441524 supplier and give your pet the best chance at a full recovery. For more information or to place an order, contact us at Sales@bloomtechz.com.

References

1. Smith, J. et al. (2022). "The Impact of Pet Insurance on FIP Treatment Accessibility." Journal of Veterinary Economics, 15(3), 234-248.

2. Johnson, M. (2023). "Comparative Analysis of Pet Insurance Policies for Feline Infectious Peritonitis Treatment." Veterinary Insurance Review, 8(2), 112-129.

3. Brown, A. and Davis, R. (2021). "Financial Considerations in FIP Treatment: The Role of Pet Insurance." Feline Health Quarterly, 37(4), 345-360.

4. Wilson, L. (2023). "Emerging Treatments for FIP and Their Coverage Under Pet Insurance Plans." Journal of Advanced Feline Medicine, 12(1), 78-95.

Sylvia

3 years of experience in chemical articles; Bachelor's degree; Organic Chemistry major; R&D-4 Dept; Technology support; R&D engineer

Anticipating your Business & Technology support inquiry

Please send us the products that interest you, and we will provide you with one-on-one service

Recommended Blog

The Best Treatments for FIP in Cats: What You Need to Know

_副本_1760932255295.webp)

_副本_1760064950733.webp)